New Skills for a Different Sport: Alliance Managers Wade into M&A, Integration Waters

Posted By Jon Lavietes, Friday, November 13, 2020

Mergers, acquisitions, and divestments is a different world from alliance management, yet these disciplines end up overlapping from time to time, so some alliance managers have gotten a taste of it in small doses. Should alliance managers dip their tortilla chips deeper into the integration salsa and ask for a larger helping of pharmaceutical transaction responsibilities? It’s a question that was addressed in a 2020 ASAP Global Alliance Summit session and reprised by a few of those panelists in a 2020 ASAP BioPharma Conference roundtable titled “Becoming Triathletes—Building a Multidisciplined Team to Deliver High-Performing Alliances, M&A, and Divestments.”

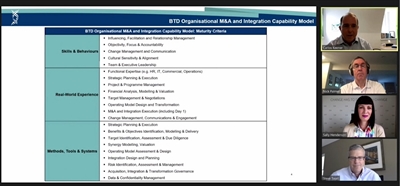

Steve Twait, CSAP, vice president of alliance and integration management at AstraZeneca, framed the discussion at the outset by comparing alliance management to a marathon. He and a triumvirate of BTD Consulting executives were set to explore how alliance professionals “can add skills and competencies to do what perhaps triathletes have to, which is add a couple more important sports to their repertoire. We’re going to talk about the core skills that we have as alliance managers, and how we might need to evolve those and grow those to be successful in running an integration, an acquisition, or perhaps a transition into a divestment.”

Fear and Uncertainty: M&A Demands EQ from AMs

Nick Palmer, managing director at BTD Consulting, who was involved with ASAP in the association’s early beginnings but veered away from the alliance world over the last decade or so to pursue mergers, acquisitions, and integrations, expanded on the metaphor to illustrate how an alliance management background has advantages and disadvantages in a transaction setting.

“The challenge when you hone things and become a really good marathon runner is that certain other muscles atrophy or aren’t as well developed. The greatest marathoners aren’t the greatest triathletes,” he said.

You could say that alliance managers’ high EQ represents the super-strong quad muscles. That ability to understand people’s situations in their business and professional contexts, which can help keep a 10- or 15-year alliance on course, is also indispensable in an M&A situation.

“Two things you can be certain of in an M&A situation are fear and uncertainty. People are worried, and they’re not worried about what’s going to happen to the strategic direction of my company. They’re worried about what’s going to happen to me. Am I going to lose my job? Am I going to lose my status? Is my friend going to lose her job? There is fear there at a personal level, and that fear will get in the way of everything if you don’t honestly address and understand it. Alliance managers are uniquely skilled in understanding that uncertainty,” said Palmer. “Alliance managers are hypersensitive to and hyperaware of why people are where they are. That gives you an opportunity in this fear setting to be honest and genuine with people, and to meet them where they are and help them to understand that even in this context where things are at risk, there are benefits and there is upside.”

Alliance managers can also help break M&A folks out of their “mechanical process,” as Palmer described it—the narrow view that the acquired asset will simply plug into the larger organizational machine for a fit purpose. Alliance professionals can serve as “trailblazers” in the transactional context by figuring out other uses, benefits, and ways to connect the acquired company to the larger organization.

“This is really good for what we bought it for, and there are several other things we can do [with this acquired asset],” said Palmer, illustrating this hypothetical mindset.

This One Goes to 11: Turning Up the Dial on Culture Shock

However, as Palmer mentioned earlier, integrations can also feel like the wild west to alliance managers, particularly as it pertains to culture. Where alliance professionals are taught to respect allies’ cultures and forge a third alliance culture, so to speak, that bridges partner organizations, you can’t always be so accommodating in an acquisition setting.

“It’s not that you don’t care about the other company’s culture, but oftentimes you are integrating that company into a parent company,” said Twait, who spent 15 years executing Eli Lilly’s development and commercial alliances before moving to AstraZeneca to run its alliances and integrations in 2015.

“In an acquisition, there is going to be culture change by definition,” said Palmer. “Are we integrating you to be like us because we think we have an operating model that you would be a solid part of? In which case, let’s be blunt about it.”

Carlos Keener, a 20-year veteran of mergers and acquisitions and managing partner at BTD Consulting, relayed a comment he heard from a Google executive about how company culture is dealt with by the internet giant.

“‘We turn the dial up on culture the minute people arrive at the office. We make sure they know exactly what kind of culture they are coming into, and we make sure they know where the exit door is.’ The cultures integrate because the right people leave and the right people stay, which clearly isn’t how you do it in an alliance,” said Keener.

Another potential blind spot: In the crunch to execute a transaction, alliance managers will interact with more company stakeholders, and in a different manner, than they are used to.

“You’re not dealing with finance, human resources, IT—you may be dealing with some of them, [but] you’re not dealing with the full business model. In M&A, you are bringing that baby on board, and you are connecting it everywhere. If you don’t have that knowledge yourself as an alliance manager, you need to surround yourself with people who have those skills,” said Palmer.

“You need to at least be able to talk the language of finance, IT, HR. You need to be able to talk about the hard and soft stuff. You need to be able to think strategically. You should be able to have a discussion about the overall commercial strategy for the business in the morning, and then in the afternoon be equally happy talking to someone and working out where the logo needs to go on the new purchase order form,” said Keener.

Onside Kick: You Won’t Recover from a Fumbled Integration

Most important, alliance managers must understand that M&A is an event, not a process. Normally marathoners who manage decade-plus partnerships, alliance managers may need to strengthen those fast-twitch muscles and realize that things have to get done quickly, if not perfectly, in a short amount of time.

“In alliances, we have alliance kickoffs, but if you don’t get it quite right at that kickoff, you still have plenty of time to get the group on track. In alliances, we have several chances to—maybe when an alliance goes from phase 1 to phase 2 and phase 3—sort of ‘re–kick off.’ In an integration there’s only one day 1,” said Twait.

Keener said that if someone wasn’t showing a great sense of urgency, “I would say, ‘Thank you very much,’ and then show them the exit. You only have one chance to make that first impression. It’s counterintuitive because you bought the company so you’d think, ‘We have it forever. Surely, we’ll have the opportunity to go do it again.’ But oddly enough, you don’t, because sponsors tend to lose interest; they go off to do other things. There’s an expectation that you’re going to put a lot of time, energy, and resources into this and then stop.”

Stares and Glares

Make no mistake: the pressure is on.

“You are under a much more intense stare from the senior team in an integration. Like lots of intense stares, it will go away fairly quickly—and that’s one of the challenges: people tend to lose interest very quickly. The board, the exec team, the market, and your investors will have you in a fishbowl. Therefore, what you report—the degree to which you are reporting on benefits immediately, or your ability to be on track to deliver those immediate benefits—is much more important in an integration. Showing what you’re doing about managing risk and so on is, I would suspect, more intense in the beginning than it might be in an alliance,” said Keener.

Stumble early in an integration and it could have effects that last decades. Palmer recounted a story from another industry—Chevron, which bought competitor Gulf Oil in the 1980s—to illustrate the point.

“Gulf is still not properly integrated culturally. You can still tell a Gulf person today in the 2000s from an acquisition done poorly,” he said. “Mistakes you make now will live with you for a long period of time.”

With stakes high and time short, Palmer exhorted viewers “to be willing to make adequate decisions, not the perfect decision, but…in a structured framework.”

“Perfect is very much the enemy of good enough,” concurred Keener.

Monkey Mind vs. Change-Ready Mindset

Although time may be short, Sally Henderson, principal coach at BTD Consulting, gave alliance managers some advice that may sound counterintuitive.

They should “stop, pause, and not just rush forward to get stuff done,” she said. Henderson reasoned that fear and insecurity has a way of engulfing people amidst the uncertainty induced by an acquisition and integration, and “can cause people to go into default settings and habits that in certain scenarios work very well but actually can be completely counterproductive because the situation has changed, but the person hasn’t recognized it.”

Henderson, a former entrepreneur who specializes in leadership mentoring, career shifts, and talent development, divulged her “3M” model of leadership: 1) mindset, 2) motivation, and 3) manner.

To the first pillar, Henderson exhorted viewers to embrace change. This may sound obvious, but she noted that it’s not always easy to consciously recognize that you fear it.

“If your mindset isn’t set up to be change-ready, everything else is going to be difficult—and sometimes actually impossible. The challenge around this is that this can be happening in you, as an alliance manager, on a subconscious level,” she said. “Am I coming into this with a lens that is positive, or am I coming into this where fear is actually distorting things? Weirdly enough, I want to be proven right that this won’t work. Our subconscious mind can be a real monkey at times.”

Bless This Mess

How can you be sure that you are ready for the chaos that will ensue in a transaction? Henderson suggested alliance managers consciously tell themselves, “I welcome not knowing, I welcome getting messy, I welcome being out of control. I imagine that the level of control in an alliance is different from the level of control in an M&A, and the pace at which that happens,” she said. “Am I, from my inside out, change-ready?…Are my beliefs healthy? Therefore, am I going to radiate positive energy, positive contribution to my colleagues?”

To answer these questions, Henderson preached the importance of understanding yours and other stakeholders’ motivation, the second pillar of the 3M framework, in the moment. This process starts with one of Henderson’s favorite questions.

A Drop of Fuel in the Reward Bucket

“Where’s your fuel coming from? Fuel can still be effective even when it’s toxic,” she noted. “You want your fuel to be really nourishing, sustaining, and attractive to yourself and to others.”

This logically leads to the next question: “How do you know where fuel comes from and how to keep it alight in a really healthy way?” asked Henderson. The answer is revealed in part by a process BTD Consulting calls “motivational map profiling.” First, you must understand whether people’s motivation comes from the past, present, or future.

“Future-oriented people, change to them is oxygen. They utterly need to hang out there. For past-motivated people, change is very scary. Here’s the thing: They can thrive. It’s not that it’s impossible, it’s just that they need more signaling, more communication, more guardrails around the change to feel secure,” said Henderson.

There is a tool that can replace fear with positive motivation. Henderson calls it a “reward bucket.”

“If I’ve got the right reward in my mind, it’s going to enable me to act much more confidently, in a more fluid way, and quicker,” she said.

She gave an example of a CEO whose reward bucket was to be accessible to his employees. However, as his company grew with acquisitions, it was no longer feasible to be connected with everyone in his company, which made him feel that he was underperforming. Once he became comfortable with this new reality, he realized he could replace his reward bucket with a new standard for success that fit his changing situation.

Henderson suggested listing three to five main rewards, ordering them, and then defining them in the context of who you are today and where you are going tomorrow.

Mind Your Manner: Pacing Yourself and Your Team for Change

For the third “M,” manner, Henderson stressed that alliance managers understand that people “work at different pace, they have a different focus, and they’re geared to deliver different [linear] outcomes” in their normal workplace state. However, the needs of a situation change drastically when a team of players who may not be familiar with one another collaborate on a crucial transaction in a short period of time.

“Conflict comes because people don’t understand the difference—a pace that is suitable for one scenario is counterproductive [for another]. That doesn’t mean to say that it’s wrong. It’s just not right for that scenario,” she said. “What pace do I need to be working at, to be leading at, to be driving the change that I’m responsible for? All of these scenarios have one big common thing, which is that they are all change. It’s just at a different pace, with a different focus, with a different outcome.”

Henderson, Twait, Palmer, and Keener dropped even more knowledge in “Becoming Triathletes—Building a Multidisciplined Team to Deliver High-Performing Alliances, M&A, and Divestments.” Time is running out for BioPharma Conference registrants to hear it. This roundtable, along with every other live and on-demand session from the conference, will be available at the event portal until Nov. 30.